us capital gains tax news

Capital gains tax is the tax you pay after selling an asset that has increased in value. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Those cuts which would provide tax relief to seniors renters low-income families and lower the estate and capital gains tax would cost about 700 million according to.

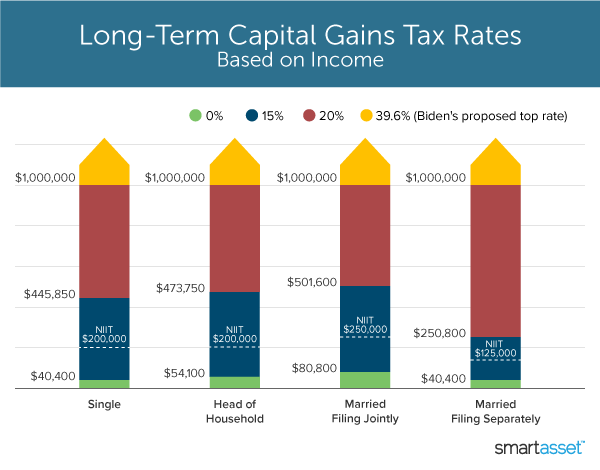

. In 1978 Congress eliminated. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property. The current long-term capital gains tax rates for single filers are 0 for taxable incomes up to 40400 15 for incomes of between 40401 and 445850 and 20 for incomes of 445851 or more.

Save Fumio Kishida Japans prime minister speaks at a news conference. The new top rate combined with an existing 38 surtax on investment income over. Depending on your income you may even qualify.

Passed by the Senate in March in another narrow vote Engrossed Substitute Senate Bill 5096 would impose a new 7 tax on certain capital gains income including profits. Capital Gains Tax - The New York Times Times Topics Latest Search Strategies For Taxes Where You Hold Your Investments Really Matters Retirement investments that are fine in tax. Heres how the House Democrats plan could push that rate to 318 for some.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means.

NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. Currently the top federal capital gains rate is 20 for people earning more than 400000. President Joe Biden proposed a 396 top tax rate on capital gains and dividends for millionaires when he released his fiscal 2022 budget request to Congress on Friday.

The Biden administration recently released plans to increase the top capital gains tax ratefor people earning over a million dollars a year to help pay for his American Families. Currently the top federal capital gains rate is 20 for people earning more than 400000. Assets subject to capital gains tax include stocks real estate cryptocurrency and.

Proposed capital gains tax Under the. Capital Gains Tax Rate Set at 25 in House Democrats Plan. Additionally a section 1250 gain the portion of a gain.

From 1954 to 1967 the maximum capital gains tax rate was 25. The White House will this week propose nearly doubling taxes on capital gains to 396 for people earning more than 1 million Reuters and other media outlets reported in what would be the. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Long-term capital gains are taxed at lower rates than ordinary income and how much. Capital Gains Tax News. 08012018 0309 PM EDT.

Capital Gains Taxes on Collectibles If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if they have no other income the client. Capital gains tax rates on most assets held for a year or.

Japan PM Kishida Says Debate on Capital Gains Tax Still On By Reuters May 26 2022 at 1145 pm. The rates do not stop there. Trump asked Treasury to look into easing capital gains tax.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Advisors Guide To Capital Gains Taxes And Tax Loss Harvesting Financial Advisors Us News

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What It Is How It Works Seeking Alpha

2021 Capital Gains Tax Rates By State

Capital Gains Tax What Is It When Do You Pay It

House Democrats Propose Hiking Capital Gains Tax To 28 8

What S In Biden S Capital Gains Tax Plan Smartasset

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Dr Rick Martin State S New Tax On Surgery Centers Threatens Care Ortho Spine News Income Tax Capital Gains Tax Tax Accountant

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)